Observations

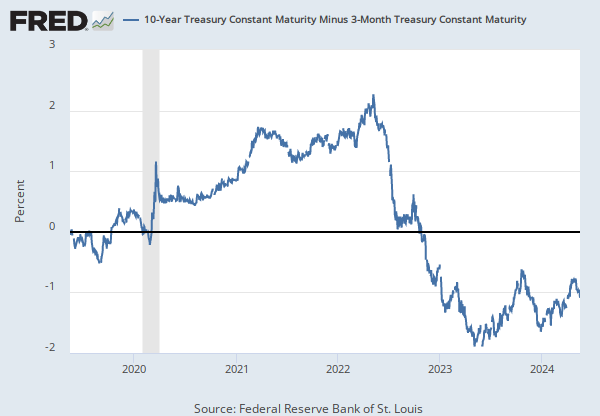

Mar 2025: 0.27 | Percentage Points, Seasonally Adjusted | Monthly

Updated: Apr 4, 2025 7:58 AM CDT

Observations

Mar 2025:

0.27

Updated:

Apr 4, 2025

7:58 AM CDT

| Mar 2025: | 0.27 | |

| Feb 2025: | 0.27 | |

| Jan 2025: | 0.37 | |

| Dec 2024: | 0.40 | |

| Nov 2024: | 0.43 |

Units:

Percentage Points,

Seasonally Adjusted

Frequency:

Monthly

Fullscreen