Observations

2011-04-15: -11.93 |

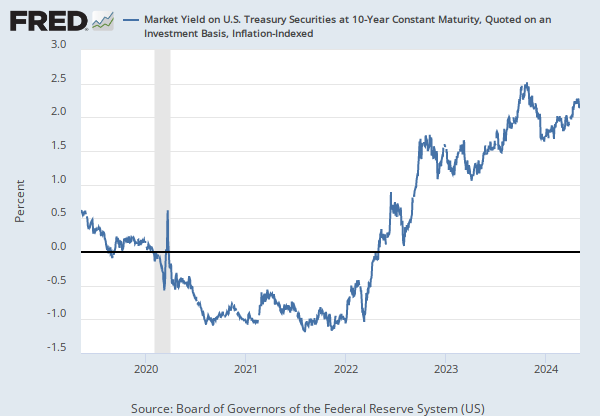

Percent, Not Seasonally Adjusted |

Weekly,

Ending Friday

Updated: Apr 25, 2011 9:24 AM CDT

Observations

2011-04-15:

-11.93

Updated:

Apr 25, 2011

9:24 AM CDT

| 2011-04-15: | -11.93 | |

| 2011-04-08: | -6.07 | |

| 2011-04-01: | -5.02 | |

| 2011-03-25: | -5.08 | |

| 2011-03-18: | -4.70 |

Units:

Percent,

Not Seasonally Adjusted

Frequency:

Weekly,

Ending Friday

Fullscreen