Observations

2019-01-11: 4.279 |

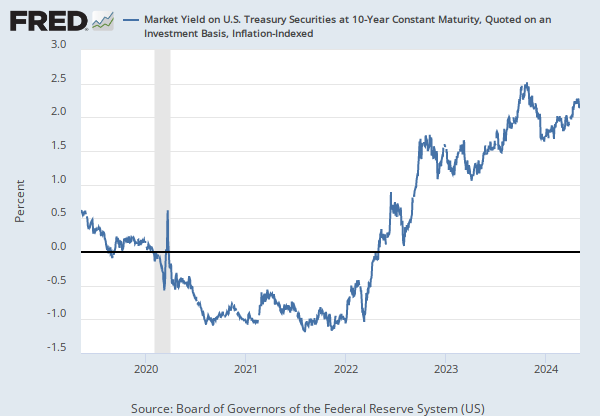

Percent, Not Seasonally Adjusted |

Weekly,

Ending Friday

Updated: Jan 14, 2019 1:01 PM CST

Observations

2019-01-11:

4.279

Updated:

Jan 14, 2019

1:01 PM CST

| 2019-01-11: | 4.279 | |

| 2019-01-04: | 5.839 | |

| 2018-12-28: | 4.545 | |

| 2018-12-21: | 3.127 | |

| 2018-12-14: | 2.802 |

Units:

Percent,

Not Seasonally Adjusted

Frequency:

Weekly,

Ending Friday

Fullscreen