Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

| Title | Release Dates | |

|

|

||

| Effect of the American Recovery and Reinvestment Act (ARRA) on Federal Government Current Tax Receipts: Taxes on Corporate Income (DISCONTINUED) | 2013-06-27 | 2013-06-27 |

| Source | ||

|

|

||

| U.S. Bureau of Economic Analysis | 2013-06-27 | 2013-06-27 |

| Release | ||

|

|

||

| Federal Recovery Programs and BEA Statistics | 2013-06-27 | 2013-06-27 |

| Units | ||

|

|

||

| Billions of Dollars | 2013-06-27 | 2013-06-27 |

| Frequency | ||

|

|

||

| Quarterly | 2013-06-27 | 2013-06-27 |

| Seasonal Adjustment | ||

|

|

||

| Seasonally Adjusted Annual Rate | 2013-06-27 | 2013-06-27 |

| Notes | ||

|

|

||

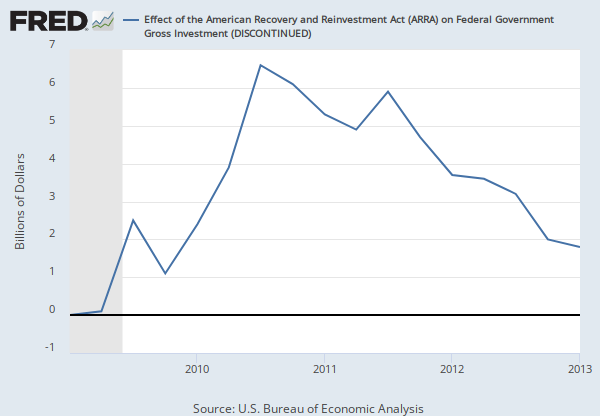

|

The estimated effect of ARRA on selected NIPA estimates of federal receipts and expenditures. Includes special allowances for certain property acquired during 2009 and other business tax incentives. Estimates of the ARRA’s effects on the NIPAs will not be available for periods after the first quarter of 2013 due to the lack of availability of source data and the declining impact of the ARRA on the NIPAs. For more information about the ARRA, visit http://www.ed.gov/open/plan/recovery-gov. |

2013-06-27 | 2013-06-27 |

RELEASE TABLES

Federal Recovery Programs and BEA Statistics