Observations

2025-04-16: 0 |

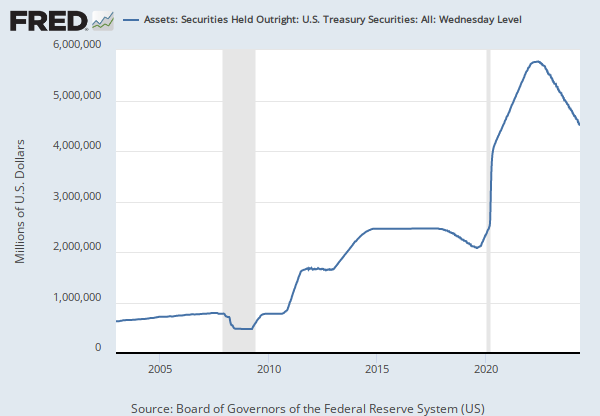

Millions of U.S. Dollars, Not Seasonally Adjusted |

Weekly,

As of Wednesday

Updated: Apr 17, 2025 3:43 PM CDT

Observations

2025-04-16:

0

Updated:

Apr 17, 2025

3:43 PM CDT

| 2025-04-16: | 0 | |

| 2025-04-09: | 0 | |

| 2025-04-02: | 0 | |

| 2025-03-26: | 0 | |

| 2025-03-19: | 0 |

Units:

Millions of U.S. Dollars,

Not Seasonally Adjusted

Frequency:

Weekly,

As of Wednesday

Fullscreen