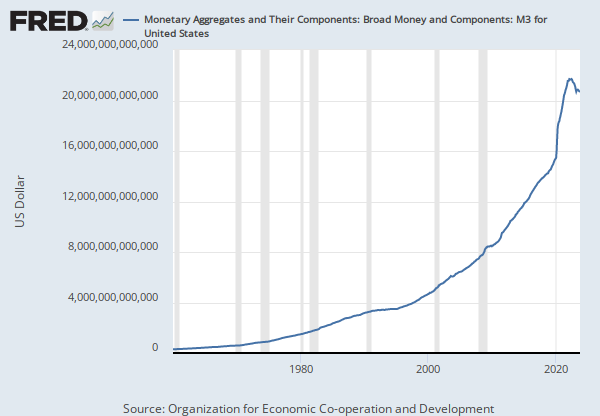

Home > Releases > Monetary Services Index (MSI) > Monetary Services Index: M3 (preferred) (DISCONTINUED)

Feb 2006: 9,536.1 |

Billions of Dollars |

Monthly |

Updated:

May 17, 2013

9:01 AM CDT

Observation:

Feb 2006: 9,536.1 (+ more) Updated: May 17, 2013 9:01 AM CDT| Feb 2006: | 9,536.1 | |

| Jan 2006: | 9,497.1 | |

| Dec 2005: | 9,450.5 | |

| Nov 2005: | 9,400.2 | |

| Oct 2005: | 9,367.4 |

Units:

Billions of Dollars,Seasonally Adjusted

Frequency:

Monthly