Observations

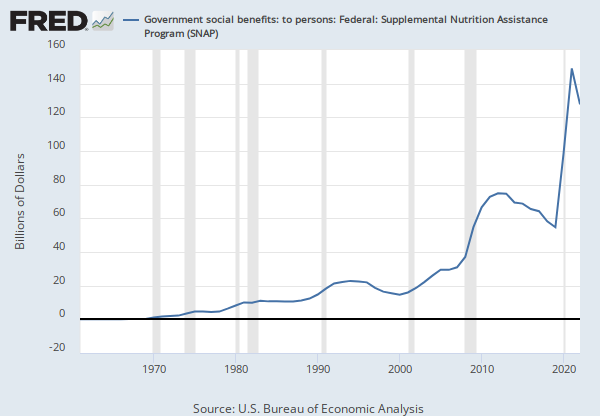

2016: 66,723,338 | Thousands of U.S. Dollars, Not Seasonally Adjusted | Annual

Updated: Dec 19, 2018 1:31 PM CST

Observations

2016:

66,723,338

Updated:

Dec 19, 2018

1:31 PM CST

| 2016: | 66,723,338 | |

| 2015: | 68,524,975 | |

| 2014: | 68,339,181 | |

| 2013: | 68,084,086 | |

| 2012: | 64,128,627 |

Units:

Thousands of U.S. Dollars,

Not Seasonally Adjusted

Frequency:

Annual

Fullscreen